Why Budgeting is Important for Students? Discover Means and Ways to Understand a Balanced Budget!

Abstract

Creating a budget allows students more financial freedom because they are aware of how much money they can spend on certain things upfront. Budgeting takes away the dreaded guessing game of “can I afford this?” The instant gratification of purchasing something that may not fit in the budget tends to outweigh the consequences of debt for students. The goal is to steer them away from this type of attitude and replace it with an eagerness to budget.

Keywords

Budget, Budgeting, Students, Goals, Money, Expenditure, Learning

Learning Outcomes

After undergoing this article you will be able to understand the following

1. Why budgeting is Important for Students?

2. How to make your budget as student?

3. How to determine Wants and Needs?

4. How you may save money as student?

5. Conclusions

1. Why budgeting is Important for Students?

A budget will also help you prepare for unexpected expenses and obstacles. Budgeting involves challenging decision-making, but setting goals will make the tough choices a little easier.

Learning how to manage your finances as a student for the first time is always tricky. There is nothing like living on your own for the first time and trying to figure out how to make the money you earned over the summer last the entire academic year. While managing and budgeting your finances is definitely tricky, it is not impossible.

The first time I realized I needed to start budgeting my finances was in second year of university, when I had first moved off campus and now had to pay for rent, utilities and groceries. I had always been good at saving my money in the past, but that year I was completely overwhelmed. I couldn’t figure out where to start for budgeting, how to figure out my monthly expenses and how to pay for it all only using what money I had in my savings. I ended up leaving that school year with $50 in my account and a determination to figure out how to budget.

Budgeting can help you to:

- Identify your income and expenses and prioritize your needs and wants

- Set realistic and achievable financial goals and plan how to reach them

- Control your spending habits and avoid impulse buying

- Save money for emergencies, future plans or investments

- Build good financial habits and skills that will benefit you in the long run

2. How to Make a Budget?

Making a budget is not as difficult as it may seem. You just need to follow some simple steps:

- Estimate your monthly income from all sources and add them up

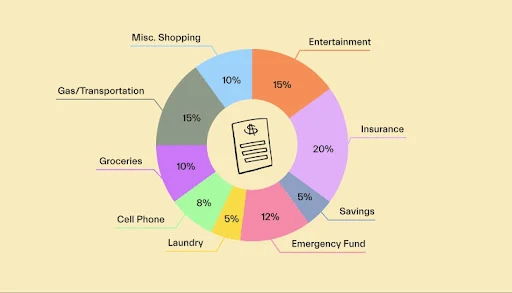

- Estimate your monthly expenses in different categories, such as fixed expenses (rent, utilities, etc.), variable expenses (food, transportation, etc.) and discretionary expenses (entertainment, hobbies, etc.) and add them up

- Subtract your total expenses from your total income to get your net income

- If your net income is positive, you have a surplus that you can save or invest

- If your net income is negative, you have a deficit that you need to cover by reducing your expenses or increasing your income

3. Methods of Making Budget as students: Tips and Tricks for Budgeting

Here are some tips and tricks that can help you to make and stick to your budget:

Use a budgeting tool or app that can help you to track your income and expenses easily and automatically

Review your budget regularly and adjust it according to any changes in your income or expenses

Set aside some money for savings every month before spending on anything else

Use cash or debit cards instead of credit cards to avoid overspending and paying interest

Compare prices before buying anything and look for discounts, coupons or deals

Avoid eating out too often and cook at home instead

Share expenses with your friends or roommates whenever possible

Attend student-friendly events that are free or low-cost

Sell or donate things that you do not need or use anymore

Reward yourself for sticking to your budget but do not splurge too much

Actions Required

Start your Spreadsheet

The best way to start budgeting is starting small, by making a monthly budget before thinking of how much you would like to spend all year.

Making a monthly budget can help you see exactly how much you need to spend on rent, food, utilities and tuition each month, and it can also help you gain a big-picture view of your expenses for the whole year.

To start, make a spread sheet and compare your expenses and income for the year; as a student, you might only be working with the money you made over the summer and any bursaries or funding that you may receive.

4. Tools to Use for Budgeting

I began budgeting with no idea where to start, but soon found that there are many fantastic budgeting tools that you can use, such as

Goodbudget

PocketGuard

EveryDollar

Mint

Personal Capital

Spreadsheets

QuickBooks

YNAB

GnuCash

Google Sheets

PlanGuru

Adaptive Insights

Customizable dashboards

Prophix

Banking tools

Honeydue

BudgetPulse

Empower

Float

Simplifi

You need a Budget

Centage

Analogous budgeting

Balance sheet budgeting

Mint,

Spendee,

You Need A Budget (YNAB) and Pocket Guard,

all of which highlights on their Awards and Financial Aid page. These tools can be used in collaboration with an Excel spreadsheet.

4. After the Spreadsheet

After making your spreadsheet you can use one of the tools listed above to track your spending for a month or you can simply save all of your receipts and add everything up at the end of the year. Personally, I feel as though the app gives you a more accurate calculation of how much you spend, and you save a few trees in the process.

5. Determine “Wants” and “Needs”

Needs and wants are an important part of an economy. Needs are things that people require to survive. Food, water, clothing, and shelter are all needs. If a human body does not have those things, the body cannot function and will die. Wants are things that a person would like to have but are not needed for survival.

After figuring out how much money you are spending each month, determine which of your expenses are necessary and which are “wants”. A necessary expense could be rent, groceries and your phone bill, while a “want” expense could be buying Starbucks when you have coffee at home.

While it is good to differentiate between needs and wants, after you determine how much you need each month and how much money you have saved, you can see if there is any extra wiggly room for extra things that you may not need. I always leave room in my budget for getting takeout once or twice a month.

Examples of Needs

Needs are usually your basic living expenses, things necessary for your health, or expenses that are required for you to do your job. These could be:

- Rent or mortgage

- Utility bills

- Health care and therapy

- Medication

- Food

- Work uniform

- Commuting

Examples of Wants

Wants are things you choose to buy but could live without, such as:

- Entertainment

- Dining out

- Home purchases

- Travel

- Electronics

- Monthly subscriptions or memberships

- TV or music streaming accounts

- New clothing

6. Helpful Money-Saving Tips

Making your budget is the easy part but sticking to it is even harder – finding ways to save money each month is key to sticking to your budget. One thing that I do in order to save money is check the grocery fliers to see what is on sale before planning my grocery list, and I always try to buy as much as I can in bulk, as it is cheaper that way, and freeze the extra bulk items that I can’t use up right away.

Some great money-saving tips and tricks are as follows for students

11 Things to know about how to save money

Tip #1 - Keep track of your expenses. ...

Tip #2 - Make savings a priority in your budget. ...

Tip #3 - Establish your financial priorities. ...

Tip #4 - Allocate a budget. ...

Tip #5 - Evaluate your spending habits. ...

Tip #6 - Involve your family. ...

Tip #7 - Find ways to reduce spending.

Tip #8 - Set savings goals

Tip #9 - Open a savings account

Tip #10 - Invest in savings plans

Tip #11 - Automate your savings and investments

If you are interested in learning and hearing more about money, check out Career Education for Success Blog for more tips and information!

Comments

Post a Comment

"Thank you for seeking advice on your career journey! Our team is dedicated to providing personalized guidance on education and success. Please share your specific questions or concerns, and we'll assist you in navigating the path to a fulfilling and successful career."