Abstract:

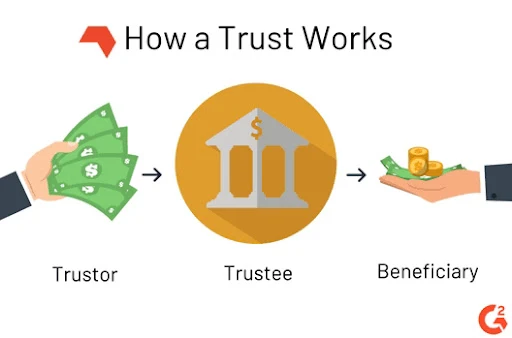

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries.

A trust is a document giving you, another person, or an institution the power to hold and manage your money for your benefit or the benefit of another person. A trust can serve many purposes, including estate planning, tax planning, medical planning, and charitable giving.

The main functions of a trust are the function of the management and disposal of the asset, the function of the conversion of untrusted property, and the function of bankruptcy isolation. These functions can be utilized to handle the various needs of trusts.

Irrevocable Trusts is the best form of trust. Using an irrevocable trust allows you to minimize estate tax, protect assets from creditors and provide for family members who are under 18 years old, financially dependent, or who may have special needs.

The 4 principles of trust are to help businesses take a step back and consider how their operational practices compare with current trust principles, we have identified four crucial trust pillars – or “principles” to keep in mind -- reciprocity, purpose, consequence and information.

Any person who is competent to contract in India can establish a public charity Trust for objectives such as poverty relief, education, medical treatment, the advancement of any cause of public value, among other examples. There are two types of public Trusts: registered and unregistered.

Keywords

Trust, Relief, Education, Medical Treatment, Charitable, Public, Private

Learning Outcomes

After undergoing this article you will be able to understand the following:

1. Introduction about Trust

2. What is exactly a Trust?

3. What's the aims and objectives of a Trust?

4. What are different types of trust?

5. What's different characteristics of a trust?

6. What's are advantages of Trust Registration in India?

7. How to form a Trust in India?

8. What documents are required for Trust Registration in India?

8. What kind of Tax Exemption are available to a trust?

9. What points are necessary to mention in the draft of a trust deed?

10. Conclusions

11. FAQs on Trust Registration in India

References

1. Introduction about Trust

The writing of a Trust Deed is the first step in registering a Trust in India. In India, the primary need for registering a Trust is a Trust deed. The Trust Deed is written on non-judicial stamp paper, and each state in India has set its own stamp duty rate. Once the applicant has completed the Trust Deed preparation, he or she must schedule an appointment with the office of the sub-registrar. It is required that all of the Trust’s Trustees, as well as the Trust Deed and two witnesses, appear before the sub-registrar on the date of appointment.

2. What is exactly a Trust?

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries.

A Trust is an arrangement in which the property is transferred to a Trustee by the owner, Trust, or Trustees. The property is transferred for the advantage of a third party. The Trust or a proclamation that the property should be held by the Trustee for the Trust’s beneficiaries transfers the property to the Trustee. The Indian Trust Act of 1882 establishes the legal framework for Trust in India. In India, Trust registration is recommended for gaining the benefits.

3. What's the aims and objectives of a Trust?

A trust, in its simplest form, is a legal arrangement in which one party (the settlor or grantor) transfers property or assets to another party (the trustee) with the purpose of holding, managing, and distributing these assets for the benefit of specific individuals or entities (the beneficiaries).

The object of the Trust must be feasible and adequately defined, and the object and purpose of the Trust must not violate the law or public order (i.e., public policy) or public morality. Otherwise, the trust agreement shall be void and the situation shall be restored to what it was before the creation of the Trust.

The general purpose of any trust is to manage and preserve property (typically money) for the benefit of one or more persons. However, a trust is usually set up for a special purpose that meets your specific needs or the needs of your beneficiaries.

4. What are different types of trust?

The different types of trust are as follows:

Generation-skipping trusts

Qualified personal residence trust

Inter vivos trusts or living trusts

Trust Categories

Below is the 2 Category in which Trust is classified in India;

Public Trust

A Public Trust is one that has the public as one of its beneficiaries. A Public Trust in India can also be separated into two types: Public Religious Trust and Public Charitable Trust.

Private Trust

In India, a Private Trust is one that has individuals or families as beneficiaries. In addition, in India, a Private Trust can be classified into the following categories

A private Trust whose beneficiaries and requisite shares are both easily determined.

A private Trust whose beneficiaries or requisite shares are both difficult to determine.

5. What's different characteristics of a trust?

The key characteristic of a trust is that it permits the separation of legal ownership and beneficial interest: the trustees become the owners of the trust property as far as third parties are concerned, and the beneficiaries are entitled to expect that the trustees will manage the trust property for their benefit.

6. What's are advantages of Trust Registration in India?

Through charity operations, the registered Trust provides much-needed financial assistance to the needy and the masses.

Trusts are particularly beneficial for ensuring capital and income tax relief. The Trust may provide better protection for the settler, beneficiaries, and Trust assets against tax laws that are more rigorous.

The Indian Trusts Act of 1882 provides the Trust with extensive legal protection. It also forbids any third party from making a frivolous claim that could jeopardize the Trust’s legal standing.

When a person and his or her family relocate to another country, it is the ideal time to set up a Trust to avoid paying taxes in the new country, thereby protecting the family’s assets and allowing for greater organizational flexibility.

7. How to form a Trust in India?

An application for Trust Registration must be submitted to the official with jurisdiction in the state to register a charity Trust. The Charity Commissioner, for example, is in charge of Trust Registration in the state of Maharashtra. The application for Trust Registration must include information such as the name of the Trust, the names of the Trustees, and the mode of succession, among other things.

A court charge stamp of INR 2 and a small Trust registration fee, which varies based on the Trust property and the State of registration, must be included with the application. A certified copy of the Trust Deed must also be included in the application. Once completed, the applicant must sign the Trust registration form in the presence of the Regional Officer or Superintendent of the Charity Commissioner’s Regional Office or a Notary.

8. What documents are required for Trust Registration in India?

Aadhaar Card, Voter ID, Passport, and DL Address are examples of proof of identity for the Trustor and Trustee. Proof of Registered Office, such as a copy of the property certificate or utility bills.

If the property is rented, the landlord must certify that there are no objections.

The purpose of a Trust deed is to provide information on the Trustee and settlor, such as a self-attested copy of their identification and their address. Proof and work experience.

Trust Deed with Accurate Stamp Value.

Photos of the Trustee and the settlor.

PAN information for the Trustee and the settlor.

8. What kind of Tax Exemption are available to a trust?

There is a widespread belief that Trusts do not have to pay taxes because they work to benefit the public. However, this is not the case. Taxes must be paid by a Trust, just like any other legal company. To be tax-exempt, a Trust must receive certification from the Internal Revenue Service for exemptions such as 80G, Section 12 A, and others.

9. What points are necessary to mention in the draft of a trust deed?

The following details must be included in the Trust Deed:

The number of Trustees and the address where the Trust is registered

Trust’s proposed name.

Rules for the Trust that have been proposed.

At the moment of Trust registration, the settlor and two witnesses must be present.

Below are the Trust Compliances that is needed after its registration:

Annual IT (Income Tax) Filing.

GST Registration (If applicable).

Shop and Establishment License – (If there is a need for employment).

Bookkeeping and Accounting.

Professional Tax Registration (If applicable).

The trust instrument/deed

The trust instrument usually sets out the following:

- the identity of the first trustees;

- the initial trust assets (in many cases trusts are created with a nominal sum, often USD10, and further assets are transferred to the trustees separately to hold subject to the trusts contained in the trust document);

- the identity of the beneficiaries;

- the period for which the trust will or may last;

- the manner in which the beneficiaries will or may benefit from the trust assets;

- the powers and duties of the trustees to manage the trust assets;

- powers relating to the appointment, retirement and removal the trustees; and

- any protections or indemnities for the trustees.

Letter of wishes

In addition to the trust instrument, it is also common for a settlor to indicate to the trustee their wishes as to the management and disposition of the trust fund in the future in a less formalised manner. The settlor’s expression is often contained in a letter of wishes which, although not legally binding, will generally be considered by the trustee to be of persuasive effect when performing their duties and, for example, determining to make a distribution out of the trust fund.

Protector

Although not required, the settlor may wish there to be a protector to ensure a degree of oversight over the trustee. Provisions can be included in the trust instrument which provide for the appointment of a protector (an individual or corporate entity usually with experience of dealing with trusts) without whose consent the trustees may not exercise certain powers and discretions.

If a protector is included, they may be given the power in the trust instrument to do the following:

- determine the law of which jurisdiction shall be the proper law of the trust;

- change the forum of administration of the trust;

- appoint new or additional trustees;

- exclude any beneficiary; and

- withhold consent from specified actions of trustees either conditionally or unconditionally.

10. Conclusions

When considering a trust, it’s useful to seek professional advice to make sure you’re making the right decision for yourself and your loved ones.

It can be relatively easy to create a trust, but you’ll still want to call in an expert, such as a lawyer with experience in trusts, to do so. Here are the steps to create a trust:

- Figure out why you want the trust. Determine why you want a trust and which kind might be useful. Do you need a living trust or one that provides tax benefits? Do you need one that protects your assets from an incompetent beneficiary? Some trusts are more tricky to create than others, so your needs will inform who you hire.

- Interview prospective lawyers. When you know what you want from a trust, it’s time to contact lawyers and see what they can offer. Not all trusts are the same, so be sure your potential future lawyer has the specific expertise you need. You should also see what the lawyer charges for the service. You might expect to pay at least a couple thousand dollars for a basic revocable trust.

- Establish the trust. Once you’ve selected a lawyer, you’ll have to work with the expert to craft a trust that meets your needs. Make sure you understand clearly what your trust can and cannot do, so that you’re getting what you pay for.

11. FAQs on Trust Registration in India

1. What are the many types of Trust Registration?

A Trust deed can be used to establish a Trust. In India, there are now two categories of Trust: Public Trust and private Trust.

2. What is the purpose of Trust in the first place?

Trusts are created to provide legal protection for the Trustor’s assets, ensuring that those assets are delivered properly to the intended beneficiaries, and to avoid or reduce inheritance or estate taxes.

3. How can I set up a Trust for income tax purposes?

The application in Form 10A for Registration of a Charitable or Religious Trust can be made on the IT department site to gain registration U/s 12A.

4. What is the procedure for a Trust’s closure?

In most cases, ‘Trust’ is unbreakable. The Trust can be combined with another Trust with identical objectives with the authorization of the court for reasons such as disqualification of Trustees, absence of Trustees, or mismanagement of the Trust.

5. Is there a certification for Trust Registration?

A Trust Registration does not require a specific certificate. Getting the Trust Deed registered with the right authorities, on the other hand, would suffice.

6. How many members should be in trust?

two

A trust must be formed by at least two or more individuals. The trust must be established in accordance with the provisions outlined in the Indian Trusts Act of 1882. None of the parties involved should be disqualified under any prevailing law in India.

References

7 Best Books About Trust

Discover a collection of insightful books about trust. Explore the power of trust in relationships, leadership, and personal growth.

What is Trust about?

In "Trust: America's Best Chance," the author delves into the importance of trust in rebuilding and strengthening the United States. Pete Buttigieg explores how trust is the foundation for progress, unity, and effective governance. Drawing from his own experiences as a former mayor and presidential candidate, Buttigieg offers insightful perspectives on how trust can be restored in a divided nation, ultimately presenting a compelling vision for a more inclusive and prosperous America.

Who should read Trust

Citizens seeking a fresh perspective on rebuilding trust in America.

Political enthusiasts interested in Pete Buttigieg's vision for trust.

Individuals looking for practical solutions to restore faith in democracy.

What is The Lost Art of Connecting about?

"The Lost Art of Connecting" by Susan McPherson offers a practical and insightful guide to building meaningful business relationships. McPherson introduces the Gather, Ask, Do method, emphasizing the importance of genuine connections in today's digital age. Through personal anecdotes and expert advice, she provides readers with actionable strategies to foster authentic relationships, enhance networking skills, and create lasting professional connections that can lead to success in the business world.

Who should read The Lost Art of Connecting

Professionals seeking to enhance their networking skills and build meaningful business relationships.

Entrepreneurs looking to establish authentic connections for business growth and success.

Individuals interested in mastering the art of building genuine and lasting professional relationships.

What is The Speed of Trust about?

"The Speed of Trust" explores the transformative power of trust in personal and professional relationships. Drawing on real-life examples and research, the authors delve into the impact trust has on productivity, collaboration, and success. They provide practical strategies for building and restoring trust, emphasizing its role as the foundation for effective leadership and organizational culture. This insightful book offers a compelling argument for trust as the key driver of high-performance teams and thriving businesses.

Who should read The Speed of Trust

Business leaders seeking to build trust within their organizations.

Individuals looking to improve their personal relationships through trust.

Anyone interested in understanding the impact of trust on success.

What is The State of Affairs about?

In this thought-provoking book, the author delves into the complex and often taboo topic of infidelity. Esther Perel challenges conventional notions and explores the reasons behind why people cheat, the impact it has on relationships, and how society perceives and deals with infidelity. With a compassionate and insightful approach, she offers a fresh perspective on the state of affairs, encouraging readers to reconsider their beliefs and assumptions about this deeply human experience.

Who should read The State of Affairs

Couples struggling with infidelity and seeking a fresh perspective.

Therapists and counselors working with individuals and couples affected by infidelity.

Anyone interested in understanding the complexities of modern relationships.

What is All Marketers Are Liars about?

In this thought-provoking book, the author explores the art of marketing in a world where trust is scarce. Through captivating storytelling, Seth Godin reveals how marketers can effectively connect with their audience by embracing authenticity. He emphasizes the power of crafting compelling narratives that resonate with consumers, challenging conventional marketing strategies. With insightful examples and practical advice, this book offers a fresh perspective on the role of storytelling in building trust and driving success in the modern marketing landscape.

Who should read All Marketers Are Liars

Marketing professionals seeking to understand the importance of storytelling.

Entrepreneurs looking to build trust and connect with customers.

Consumers interested in understanding the psychology behind marketing tactics.

What is Get the Guy about?

In this insightful guide, the author delves into the intricacies of the male mind, offering valuable secrets and strategies to help women find the love they desire. With a focus on understanding men's perspectives and behaviors, this book provides practical advice on how to attract and connect with the right partner. Packed with real-life examples and empowering tips, it is a must-read for those seeking to navigate the complexities of modern dating and relationships.

Who should read Get the Guy

Single women looking for practical dating advice and relationship tips.

Individuals seeking insights into the male perspective on love and relationships.

Anyone interested in understanding the dynamics of modern dating.

What is Collaborating with the Enemy about?

In this insightful book, Adam Kahane explores the art of collaboration in the face of disagreement, dislike, and lack of trust. Drawing from his extensive experience as a mediator and facilitator, Kahane offers practical strategies and tools to navigate complex and polarized situations. Through compelling stories and real-life examples, he demonstrates how collaboration can lead to innovative solutions and transformative change, even when working with seemingly impossible adversaries. A must-read for anyone seeking to bridge divides and find common ground in today's challenging world.

Who should read Collaborating with the Enemy

Professionals seeking strategies to navigate challenging work relationships effectively.

Leaders aiming to foster collaboration in diverse and conflicting teams.

Individuals interested in improving their ability to resolve conflicts peacefully.

Comments

Post a Comment

"Thank you for seeking advice on your career journey! Our team is dedicated to providing personalized guidance on education and success. Please share your specific questions or concerns, and we'll assist you in navigating the path to a fulfilling and successful career."